dingwen.site

Prices

Nasdaq Stock Symbol List

The NASDAQ is a publicly owned company, trading its shares on its own exchange under the ticker symbol NDAQ. The NASDAQ Stock Market - Copyright Kowloonese . See the full list of companies included in Nasdaq Index. Track their stock prices and other financial metrics to better understand NASDAQ:NDX. Symbol|Security Name|Market Category|Test Issue|Financial Status|Round Lot Size|ETF|NextShares AACG|ATA Creativity Global - American Depositary Shares, each. exchange symbol and ticker symbol for accurate results and to avoid discrepancies. For example, use “NASDAQ:GOOG” instead of “GOOG.” If the exchange symbol. Trading symbol, ^NDX. Constituents, Type, Large-cap · Market cap · US$ List of point milestones by number of trading days. edit. Milestone. NASDAQ: Company Listings ; A SPAC II Acquisition Corporation · ASCBU ; A-Max Tech Ltd Adr (MM) · AMAX ; A-Power Energy Generation Sys (MM) · APWRW ; A. Schulman. Real-Time Quotes, After-Hours Quotes, Pre-Market Quotes, Nasdaq Symbol Screener, Online Brokers, Glossary, Sustainable Bond Network Symbol Change History. For example, the ticker symbol for Nasdaq-traded Microsoft is MSFT. However Listing requirements are the minimum standards that must be met by a company. A list of all the stocks that are currently listed on the NASDAQ stock exchange in the United States. Total Stocks. Total Market Cap. The NASDAQ is a publicly owned company, trading its shares on its own exchange under the ticker symbol NDAQ. The NASDAQ Stock Market - Copyright Kowloonese . See the full list of companies included in Nasdaq Index. Track their stock prices and other financial metrics to better understand NASDAQ:NDX. Symbol|Security Name|Market Category|Test Issue|Financial Status|Round Lot Size|ETF|NextShares AACG|ATA Creativity Global - American Depositary Shares, each. exchange symbol and ticker symbol for accurate results and to avoid discrepancies. For example, use “NASDAQ:GOOG” instead of “GOOG.” If the exchange symbol. Trading symbol, ^NDX. Constituents, Type, Large-cap · Market cap · US$ List of point milestones by number of trading days. edit. Milestone. NASDAQ: Company Listings ; A SPAC II Acquisition Corporation · ASCBU ; A-Max Tech Ltd Adr (MM) · AMAX ; A-Power Energy Generation Sys (MM) · APWRW ; A. Schulman. Real-Time Quotes, After-Hours Quotes, Pre-Market Quotes, Nasdaq Symbol Screener, Online Brokers, Glossary, Sustainable Bond Network Symbol Change History. For example, the ticker symbol for Nasdaq-traded Microsoft is MSFT. However Listing requirements are the minimum standards that must be met by a company. A list of all the stocks that are currently listed on the NASDAQ stock exchange in the United States. Total Stocks. Total Market Cap.

List of Public Stock Symbols · LinkedIn – (MSFT) · Nikola Motors – (NKLA) · NIO Inc – (NIO) · Oatly – (OTLY) · Peloton – (PTON) · Petco – (WOOF) · Pinterest – (PINS). The NASDAQ Composite Index (COMP). The Bottom Line. Stock ticker symbols are unique, alphabetic codes that are used to identify publicly-. You don't need to know a specific ticker symbol to add it to your list. Just knowing the name is enough to get you started. A Stocks window showing the search. The ticker symbols of the stocks are in the file stock_dingwen.site Symbol Lookup: dingwen.site Files. Each file in the directory /nasdaq/. Download a list of all companies on NASDAQ Stock Exchange including symbol and name. My List; |; Historical prices; |; Other instruments; |; Listed companies; |; Trade Nasdaq Inc. Nasdaq Baltic · Nasdaq Stock Market. Feedback close. Site Uses. Single-letter NYSE ticker symbols · A: Agilent Technologies (previously used by Anaconda Copper, American Medical Buildings, Attwoods, and Astra AB) · B: Barnes. Track ticker changes with a sortable list of stock symbol changes that includes the old symbol, new symbol, and the date of the symbol change. Nasdaq, Inc. operates as a stock exchange. The Company provides trading, clearing, exchange technology, regulatory, securities listing, analysis, investing. My Nasdaq Analyst ; dingwen.site Inc. ULY, Common Stock ; Eupraxia Pharmaceuticals Inc. EPRX, Common Stock. Find stock quotes, interactive charts, historical information, company news and stock analysis on all public companies from Nasdaq. Full lists of US Securities on the NASDAQ, NYSE, and AMEX powered by GitHub Actions - rreichel3/US-Stock-Symbols. For additional questions on reserving or changing a symbol for trading on The Nasdaq Stock Market, you may contact us at: [email protected] NASDAQ STOCKS ; Copart, , ; CoStar Group, , ; Costco Wholesale, , ; CrowdStrike, List of companies listed on the NASDAQ Stock Exchange, including their logos and symbols. The source of the data is from the Nasdaq website. Add symbols now or see the quotes that matter to you, anywhere on dingwen.site Start browsing Stocks, Funds, ETFs and more asset classes. Create your Watchlist. Find the latest NASDAQ Composite (^IXIC) stock quote, history, news and other vital information to help you with your stock trading and investing. Discover real-time Nasdaq, Inc. Common Stock (NDAQ) stock prices, quotes, historical data, news, and Insights for informed trading and investment decisions. Listings Directory ; AA, ALCOA CORPORATION ; AACG, ATA CREATIVITY GLOBAL SPON ADS EACH REP 2 ORD SHS ; AACT, ARES ACQUISITION CORPORATION II ; AACT.U · ARES. Global Business and Financial News, Stock Quotes, and Market Data and Analysis. Cookie List. Clear. checkbox label label. Apply Cancel. Consent Leg.

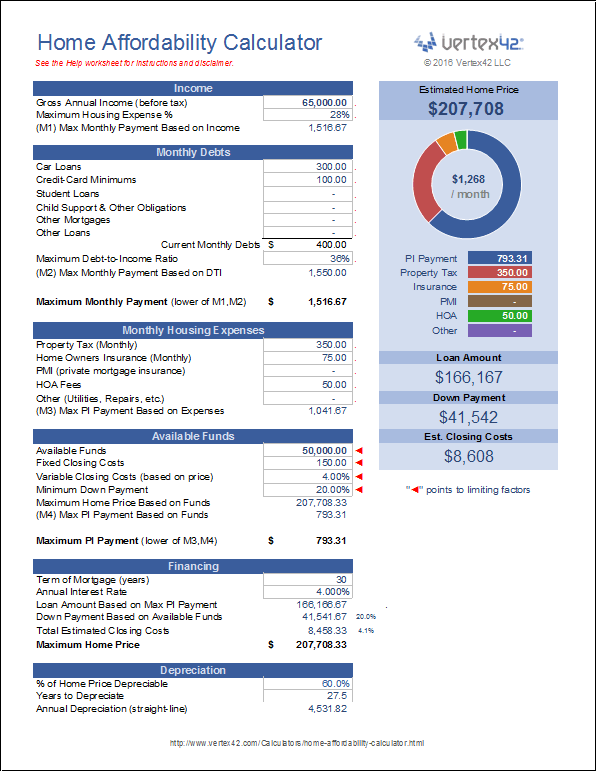

Mortgage Affordability Calculator Salary

Our mortgage affordability calculator helps you determine how much house you can afford quickly and easily with the applicable mortgage lending guidelines. You should generally aim to spend no more than 28% of your monthly pre-tax income on a mortgage payment and no more than % on total debts (including. Discover how much house you can afford based on your income, and calculate your monthly payments to determine your price range and home loan options. The affordability calculator will help you to determine how much house you can afford. The calculator tests your entries against mortgage industry standards. How much you can afford depends on your financial circumstances, such as credit score, down payment size, cash reserves, and debt-to-income ratio. When using our mortgage affordability calculator, it helps to be accurate when estimating your monthly living expenses and additional spending. Find out what you'd owe each month given a specific purchase price, interest rate, length of your loan, and the size of your down payment. One rule of thumb is to aim for a home that costs about two-and-a-half times your gross annual salary. Our home affordability calculator estimates how much home you can afford by considering where you live, what your annual income is, how much you have saved. Our mortgage affordability calculator helps you determine how much house you can afford quickly and easily with the applicable mortgage lending guidelines. You should generally aim to spend no more than 28% of your monthly pre-tax income on a mortgage payment and no more than % on total debts (including. Discover how much house you can afford based on your income, and calculate your monthly payments to determine your price range and home loan options. The affordability calculator will help you to determine how much house you can afford. The calculator tests your entries against mortgage industry standards. How much you can afford depends on your financial circumstances, such as credit score, down payment size, cash reserves, and debt-to-income ratio. When using our mortgage affordability calculator, it helps to be accurate when estimating your monthly living expenses and additional spending. Find out what you'd owe each month given a specific purchase price, interest rate, length of your loan, and the size of your down payment. One rule of thumb is to aim for a home that costs about two-and-a-half times your gross annual salary. Our home affordability calculator estimates how much home you can afford by considering where you live, what your annual income is, how much you have saved.

To calculate your DTI ratio, divide your monthly debt payments by your monthly gross income and multiply by For example, if you pay $2, toward your debt. How to use our mortgage affordability calculator To figure out how much home you can afford with our calculator, enter your gross annual income and total. Our home affordability calculator can help you get a better idea of what is within your budget. The mortgage you can afford depends on many factors. Our home affordability calculator could help you estimate how much you can afford to pay for a home as well as your estimated monthly mortgage payment and. Use our free mortgage affordability calculator to estimate how much house you can afford based on your monthly income, expenses and specified mortgage rate. Use this calculator to figure home loan affordability from the lender's point of view. A table on this page shows front-end and back-end ratio requirements. You should generally aim to spend no more than 28% of your monthly pre-tax income on a mortgage payment and no more than % on total debts (including. Industry standards suggest your total debt should be 36% of your income and your monthly mortgage payment should be 28% of your gross monthly income. Learn more. Use this tool to calculate the maximum monthly mortgage payment you'd qualify for and how much home you could afford. This calculator collects these important variables and determines your maximum monthly housing payment and the resulting mortgage amount. Free house affordability calculator to estimate an affordable house price based on factors such as income, debt, down payment, or simply budget. If you're thinking of buying a house, you can use this simple home affordability calculator to determine how much you can afford based on your current budget. Use PrimeLending’s home affordability calculator to determine how much house you can afford. Enter your income, monthly debt, and down payment to find a. What percentage of my income should go toward a mortgage? The 28/36 rule is an easy mortgage affordability rule of thumb. According to the rule, you should. Mortgage Affordability Calculator Explore how much house you can afford by entering your annual income or a fixed monthly payment. To receive the most. To determine how much you can afford for your monthly mortgage payment, just multiply your annual salary by and divide the total by This will give. You can afford a home worth up to $, with a total monthly payment of $1, ; LOAN & BORROWER INFO. Calculate affordability by · Annual gross income ; TAXES. You can afford a home worth up to $, with a total monthly payment of $1, ; LOAN & BORROWER INFO. Calculate affordability by · Annual gross income ; TAXES. The debt-to-income ratio (DTI) is your minimum monthly debt divided by your gross monthly income. The lower your DTI, the more you can borrow and the more. Use this calculator to estimate how much house you can afford with your budget Calculate affordability by. Income, Payment. Annual gross income? Must be.

Safest Nft Wallet

Top 5 NFT wallets · Ngrave · Ledger · Ellipal · Safepal · Prokey. prokey. From Malaysia comes Prokey, a crypto/NFT wallet launched in Safe{Wallet} is the most trusted smart account wallet on Ethereum with over $B secured. Zengo is the most secure non-custodial NFT and cryptocurrency wallet, with no seed phrase vulnerability, utlizing facial recognition software. Metamask - main NFT wallet for holding NFTs that need interaction, less valuable NFTs · Metamask - second account - use to interact with contracts, mint projects. Top 5 Wallets to Get Started Collecting NFTs · Metamask · Enjin · Math Wallet · Trust Wallet · AlphaWallet · YouHodler. YouHodler is a cryptocurrency lending. Safest cryptocurrency hardware wallet backed by Binance Labs. Secure your digital currency: NFTs, tokens and crypto coins such as Bitcoin - BTC. Top 5 Best Best Crypto Wallet For NFT Storage · 1. Metamask Wallet. Metamask is the most popular Ethereum-based wallet. · 2. Trust Wallet. This is a trusted free. SafePal uses cutting-edge encryption technologies and is built with a focus on security, making it one of the most secure digital wallets available for your. The non-fungible tokens are stored securely in NFT wallets. The best NFT wallet is metamask, coinbase, alpha, math, and Trust Wallet. Top 5 NFT wallets · Ngrave · Ledger · Ellipal · Safepal · Prokey. prokey. From Malaysia comes Prokey, a crypto/NFT wallet launched in Safe{Wallet} is the most trusted smart account wallet on Ethereum with over $B secured. Zengo is the most secure non-custodial NFT and cryptocurrency wallet, with no seed phrase vulnerability, utlizing facial recognition software. Metamask - main NFT wallet for holding NFTs that need interaction, less valuable NFTs · Metamask - second account - use to interact with contracts, mint projects. Top 5 Wallets to Get Started Collecting NFTs · Metamask · Enjin · Math Wallet · Trust Wallet · AlphaWallet · YouHodler. YouHodler is a cryptocurrency lending. Safest cryptocurrency hardware wallet backed by Binance Labs. Secure your digital currency: NFTs, tokens and crypto coins such as Bitcoin - BTC. Top 5 Best Best Crypto Wallet For NFT Storage · 1. Metamask Wallet. Metamask is the most popular Ethereum-based wallet. · 2. Trust Wallet. This is a trusted free. SafePal uses cutting-edge encryption technologies and is built with a focus on security, making it one of the most secure digital wallets available for your. The non-fungible tokens are stored securely in NFT wallets. The best NFT wallet is metamask, coinbase, alpha, math, and Trust Wallet.

The most premium secure touchscreen hardware wallet to protect and manage crypto and NFTs. Ledger is the easiest and safest way to secure crypto. Coin98 Super App Coin98 Super App is a dedicated multi-chain crypto wallet for DeFi that provides users a space to store and process NFT securely and. Use Cold Storage: For long-term storage, consider using cold wallets or hardware wallets to keep your NFTs offline and safe from online threats. Protect your crypto and NFTs with the power of self-custody. The Arculus® Cold Storage Wallet ensures that no one can access your digital assets but you. Simply. List of 10 best NFT wallets · 01 – Metamask Wallet · 02 – Coinbase wallet · 03 – Binance Chain Wallet – Popular Browser Extension NFT Wallet · 04 – Trust Wallet. Zengo is the most secure non-custodial NFT and cryptocurrency wallet, with no seed phrase vulnerability, utlizing facial recognition software. dingwen.site: SecuX V20 - Most Secure Crypto Hardware Wallet w/Bluetooth & NFT Support - Cross Platform - Easily Manage Your Bitcoin, Ethereum, BTC, ETH, SOL. Trust Wallet – Binance's electronic wallet with 5 million active users, is one of the most popular NFT wallets on the market. Trust Wallet allows users to store. Buy and swap cryptocurrencies with the best Crypto Wallet & Bitcoin Wallet. Secure crypto, access all of Web3 with the multichain Exodus Web3 Wallet. Coinbase Wallet is a secure web3 wallet and browser that puts you in control of your crypto, NFTs, DeFi activity, and digital assets. Phantom Wallet, Solflare, and Exodus are popular web-based Solana wallets that can be used to keep your NFTs secure. Coinbase Wallet is your key to what's next in crypto. Coinbase Wallet is a secure web3 wallet and browser that puts you in control of your crypto, NFTs. Coinbase Wallet is a secure web3 wallet and browser that puts you in control of your crypto, NFTs, DeFi activity, and digital assets. A trusted vault for storing & sharing NFTs. AnCrypto: A Platform For Adding, Receiving, & Sharing Digital Assets. A secure and powerful. Solana Wallet. Solflare is the safest way to start exploring Solana. Buy, store, swap tokens & NFTs and access Solana DeFi from web. Ledger is the easiest and safest way to secure crypto, digital assets, and your peace of mind. View Ledger wallets. Ledger Recover. Never lose access to your. Cold wallets are seen by many to be the most secure ways to store your blockchain-based non-fungible tokens. Cold wallets are physical devices disconnected from. Without physically holding the wallet device, it's impossible to hack and steal the content. The most popular hardware wallets are Trezor and Ledger. The. Compare and read user reviews of the best Free NFT Wallets currently available using the table below. This list is updated regularly. Where can collectors store their NFTs? · Software wallets · Hardware wallets · Ledger, the most popular hardware wallet.

Sendgrid Vs Gmail

SendGrid is the world's largest cloud-based email platform for delivering email that matters. SendGrid's platform increases email deliverability. How Gmail + Google Drive + SendGrid Integrations Work · Step 1: Authenticate Gmail, Google Drive, and SendGrid. · Step 2: Pick one of the apps as a trigger, which. Unsure of what to choose? Check Capterra to compare SendGrid and Gmail based on pricing, features, product details, and verified reviews. The main difference between the two services is that Elastic Email offers unlimited plans that are much cheaper than SendGrid's metered plans. Additionally. SendGrid, like most well-known email platforms, allows both marketing emails and transactional emails on their platform. In contrast, ZeptoMail was built with. Connect SendGrid with Gmail for Workspace, and over other apps, to automate your business workflows and stay productive at work. You should use the same domain for both sending and receiving. If you want to use SendGrid, you should use SendGrid for both sending and. SendGrid does automatically suppress any spam complaint address reported through traditional feedback loops. However, some webmail providers, notably Gmail, do. The email that SendGrid sends to Outlook is the same as the email that SendGrid sends to Gmail. However, every email client renders email. SendGrid is the world's largest cloud-based email platform for delivering email that matters. SendGrid's platform increases email deliverability. How Gmail + Google Drive + SendGrid Integrations Work · Step 1: Authenticate Gmail, Google Drive, and SendGrid. · Step 2: Pick one of the apps as a trigger, which. Unsure of what to choose? Check Capterra to compare SendGrid and Gmail based on pricing, features, product details, and verified reviews. The main difference between the two services is that Elastic Email offers unlimited plans that are much cheaper than SendGrid's metered plans. Additionally. SendGrid, like most well-known email platforms, allows both marketing emails and transactional emails on their platform. In contrast, ZeptoMail was built with. Connect SendGrid with Gmail for Workspace, and over other apps, to automate your business workflows and stay productive at work. You should use the same domain for both sending and receiving. If you want to use SendGrid, you should use SendGrid for both sending and. SendGrid does automatically suppress any spam complaint address reported through traditional feedback loops. However, some webmail providers, notably Gmail, do. The email that SendGrid sends to Outlook is the same as the email that SendGrid sends to Gmail. However, every email client renders email.

Mailazy is a solid SendGrid alternative, providing everything you'll need for sending application emails, processing inbound email, and tracking user engagement. This comparison guide will look at the pros and cons of Mailjet and SendGrid, including pricing, features, customer reviews and more. Set up of Marketing Campaigns is challenging; you may have to pay for expert assistance. SendGrid: Pros vs Cons apple mail vs gmail cover image with two. Amazon SES and Sendgrid used to be favored for sending transactional emails but can be used for sending other email types, although with some limitations. Compare SendGrid and Gmail based on features, pricing, verified reviews, integrations & more. Find out which software is best for your business today. SendLayer provides everything you need for sending emails and tracking user engagement. Discover why we believe SendLayer is a solid alternative to SendGrid. Compare SendGrid vs Gmail for Irish businesses. GetApp provides a side-by-side comparison with details on software price, features and reviews. At Outgrow, users can email their customers and prospects using their SMTP server. This document will help you understand how to use a free Gmail account or. Whether you need to send cold emails, mail merges, email marketing messages, internal comms, or invitations, GMass can do it all — and all inside Gmail. Sign in to SendGrid and go to Settings > API Keys. · Create an API key. · Select the permissions for the key. At a minimum, the key must have Mail send. Final consideration: This is a poor idea. You should use the same domain for both sending and receiving. If you want to use SendGrid, you should. Step 1: Set up n8n · Step 2: Create a new workflow to connect Gmail and SendGrid · Step 3: Add the first step · Step 4: Add the Gmail node · Step 5: Authenticate. It includes productivity and collaboration tools for work: Gmail for custom business email, Drive for cloud storage, Docs for word processing, Meet for video. In the Email Management market, SendGrid has a % market share in comparison to Benchmark Email's %. Since it has a better market share coverage. Compare Google Workspace and Twilio SendGrid Email API head-to-head across pricing, user satisfaction, and features, using data from actual users. What are the differences between SendGrid and Mailgun? One has a great WYSIWIG editor; the other is laser focused on helping you reach more of your list. 11 Sendgrid Alternatives For Your Business Email · dingwen.site · DuoCircle · Sendinblue · Mailtrap · Constant Contact · Pepipost · WP Mail SMTP · Amazon SES. While SendGrid provides 3 days of message event history and offers 30 days of history as a paid upgrade, Postmark provides a full 45 days of both message events. If you need your emails to be sent in a time-sensitive manner, I'd recommend SendGrid. We were using Mailgun and the lag because they aren't "transactional" in.

What Are The Best Tax Free Municipal Bonds

/GettyImages-687018872-b957a47409a8408597583efd42fc9258.jpg)

Information about tax-advantaged bonds, including tax-exempt, tax credit and direct pay bonds. Resources for issuers, borrowers and bond professionals. PGIM Muni High Income Fund may appeal to investors seeking competitive tax-exempt yields by investing in a blend of higher and lower rated muni bonds. Their interest payments are usually exempt from federal income taxes and may be exempt from state income taxes if the bond issuer is located in the investor's. With $50K you can probably get a Separately Managed Account with an assortment of munis maturing on different dates. I prefer SMAs to ETFs. Reasons to consider municipal bonds · Interest income generally federally tax exempt · Low level of default risk relative to other bond types. This has made them a compelling choice for investors seeking a reliable source of income that is also usually free from regular federal income tax. On an after-. Nobody likes to pay taxes. That's why investors naturally are interested in earning tax-free income. Municipal bond issues are a very popular way to earn. Municipal bonds often are structured to provide tax advantages. If a municipal bond is tax-exempt, the interest income is not subject to taxation by the federal. While municipal bonds and corporate bonds have many similarities, the income earned on munis is generally exempt from federal income taxes. To truly discern the. Information about tax-advantaged bonds, including tax-exempt, tax credit and direct pay bonds. Resources for issuers, borrowers and bond professionals. PGIM Muni High Income Fund may appeal to investors seeking competitive tax-exempt yields by investing in a blend of higher and lower rated muni bonds. Their interest payments are usually exempt from federal income taxes and may be exempt from state income taxes if the bond issuer is located in the investor's. With $50K you can probably get a Separately Managed Account with an assortment of munis maturing on different dates. I prefer SMAs to ETFs. Reasons to consider municipal bonds · Interest income generally federally tax exempt · Low level of default risk relative to other bond types. This has made them a compelling choice for investors seeking a reliable source of income that is also usually free from regular federal income tax. On an after-. Nobody likes to pay taxes. That's why investors naturally are interested in earning tax-free income. Municipal bond issues are a very popular way to earn. Municipal bonds often are structured to provide tax advantages. If a municipal bond is tax-exempt, the interest income is not subject to taxation by the federal. While municipal bonds and corporate bonds have many similarities, the income earned on munis is generally exempt from federal income taxes. To truly discern the.

For residents of New York City, City bonds may be triple-tax exempt. This means that New York City residents who buy tax-exempt bonds may not have to pay. Simply put: investors have the ability to reduce their tax burden by allocating from taxable bonds to municipal bonds. Why does the Federal Government permit. In a volatile market environment, municipal bonds strive to deliver tax-free income and can potentially provide equity diversification when stocks sell off. Investing in municipal bonds can provide investors with tax-exempt income. 7 min read. Municipal bond commentary · Municipal Bonds Municipal bonds: poised for. This low-cost municipal bond fund seeks to provide a high level of federally tax-exempt income and typically appeals to investors in higher tax brackets. The best muni bonds from any issuer are rated AAA. They are issued by state and local governments nationwide and their bonds have been deemed AAA by one of the. Large dedicated muni portfolio management team, supported by muni credit and quantitative analysts who further leverage the firm's taxable resources. Here are seven types of taxes that could apply if you buy muni bonds. Although municipal bonds may not be totally tax-free, we generally don't suggest investors. Municipal bonds offer income exempt from taxes. Keep more of what you earn. You Deserve Exceptional Personal Service. The Hennion and Walsh experience means you. If state and local governments lose the ability to use tax-exempt bonds and are compelled to issue taxable bonds as an alternative, it is estimated that debt. Here are seven types of taxes that could apply if you buy muni bonds. Although municipal bonds may not be totally tax-free, we generally don't suggest investors. Top 5 Municipal Bond Funds for · BlackRock Allocation Target Shares Series E (BATEX) · BlackRock High Yield Municipal Fund Investor A Shares (MDYHX). muni bonds that are AAA rated, the highest credit quality, have an almost 0% default rate. they always pay out as agreed, and you always get. One of the best instruments to help aid in tax efficiency is tax free municipal bonds. The income earned on tax free municipal bonds is federally income tax. Interest income from municipal bonds is exempt from federal income tax. In addition, municipal bonds issued within your state may be exempt from state and local. As of March 31, muni bonds were yielding %. But their taxable-equivalent yield (the return required on a taxable bond to make it equal to the return of a. Tax-exempt muni bonds hold numerous advantages over corporate bonds—a big one is that the interest investors earn is exempt from federal taxes and most. Bonds issued by government agencies are called municipal bonds. The proceeds If tax-exempt bonds are to be used to finance such facilities, certain. Features and benefits of Investing in municipal bonds. The primary feature of municipal bonds that causes them to be very popular with investors is the. Fidelity® Tax-Free Bond Fund FTABX · Fidelity® Municipal Income Fund FHIGX · T. Rowe Price Tax-Free Income Fund · Eaton Vance National Municipal Income Fund.

How Much Of A Mortgage Can We Afford

A general guideline for the mortgage you can afford is % to % of your gross annual income. However, the specific amount you can afford to borrow. How much money do you make each year? Rule of thumb says that your monthly home loan payment shouldn't total more than 28% of your gross monthly income. Gross. Mortgage affordability calculator. Get an estimated home price and monthly mortgage payment based on your income, monthly debt, down payment, and location. Your home affordability amount is the payment amount that comfortably fits into your monthly budget. It's best to keep your mortgage payment around 25% of your. Experts suggest keeping your monthly payment to less than 28% of your monthly income. Learn more about how to get the home you want, that you can afford. Mortgage Affordability Calculator Explore how much house you can afford by entering your annual income or a fixed monthly payment. To receive the most. Another general rule of thumb: All your monthly home payments should not exceed 36% of your gross monthly income. This calculator can give you a general idea. The other ratio involves all of your loan payments – your housing expenses (including any HOA fees, if applicable) and your total monthly debts (but not. Ideally, borrowers should aim to spend 28% or less of their gross annual income on a mortgage. Monthly debt — Monthly debts impact how much of a mortgage you. A general guideline for the mortgage you can afford is % to % of your gross annual income. However, the specific amount you can afford to borrow. How much money do you make each year? Rule of thumb says that your monthly home loan payment shouldn't total more than 28% of your gross monthly income. Gross. Mortgage affordability calculator. Get an estimated home price and monthly mortgage payment based on your income, monthly debt, down payment, and location. Your home affordability amount is the payment amount that comfortably fits into your monthly budget. It's best to keep your mortgage payment around 25% of your. Experts suggest keeping your monthly payment to less than 28% of your monthly income. Learn more about how to get the home you want, that you can afford. Mortgage Affordability Calculator Explore how much house you can afford by entering your annual income or a fixed monthly payment. To receive the most. Another general rule of thumb: All your monthly home payments should not exceed 36% of your gross monthly income. This calculator can give you a general idea. The other ratio involves all of your loan payments – your housing expenses (including any HOA fees, if applicable) and your total monthly debts (but not. Ideally, borrowers should aim to spend 28% or less of their gross annual income on a mortgage. Monthly debt — Monthly debts impact how much of a mortgage you.

To determine how much you can afford for your monthly mortgage payment, just multiply your annual salary by and divide the total by This will give. When you're buying a home, mortgage lenders don't look just at your income, assets, and the down payment you have. They look at all of your liabilities and. Understanding the 28/36 rule for home affordability · You should spend no more than 28% of your monthly income on your housing payment · Your total debts —. How much house can I afford? Learn the difference between a mortgage prequalification and mortgage preapproval. Prequal vs preapproval? It often depends on. First, a standard rule for lenders is that your monthly housing payment should not take up more than 28% of your gross monthly income. Not sure how much mortgage you can afford? Use the calculator to discover how much you can borrow and what your monthly payments will be. How much house can I afford if I make $50,, $70,, or $, a year? As noted in our 28/36 DTI rule section above, multiplying your gross monthly. Calculate how much house you can afford using our award-winning home affordability calculator. Find out how much you can realistically afford to pay for. If you put less than 20% down on a home, your monthly payment will also include private mortgage insurance (PMI) to help protect the lender in case you stop. Housing expenses should not exceed 28 percent of your pre-tax household income. That includes your monthly principal and interest payments, plus additional. Our calculator estimates what you can afford and what you could get prequalified for. Why? Affordability tells you how ready your budget is to be a homeowner. What mortgage can I afford? The most you can borrow is usually capped at four-and-a-half times your annual income. It's tempting to get a mortgage for as much. How Much Can You Afford? ; LOAN & BORROWER INFO. Calculate affordability by · Annual gross income · Must be between $0 and $,, · Annual gross income ; TAXES. To find out how much house you can afford, multiply your 5% down payment by 20 to find the price of the home you'll be able to buy (5% down payment x 20 = %. Find out how much house you can afford with our home affordability calculator. See how much your monthly payment could be and find homes that fit your. For example, the 28/36 rule suggests your housing costs should be limited to 28 percent of your total monthly gross income and 36 percent of your total debt. What percentage of my income should go toward a mortgage? The 28/36 rule is an easy mortgage affordability rule of thumb. According to the rule, you should. Use the home affordability calculator to help you estimate how much home you can afford. Calculate your affordability. Note: Calculators. To calculate your DTI ratio, divide your monthly debt payments by your monthly gross income and multiply by For example, if you pay $2, toward your debt. Loans and Mortgages. How Much Mortgage Can I Afford? Keep in mind that just because you qualify for that amount, it does not mean you can afford to be.

Best Intro Credit Card Deals

Chase Sapphire Preferred and Marriott Bonvoy Boundless are two of the best options right now - not just for that price point, but overall. 0% † Intro APR for your first 15 billing cycles for purchases, and for any balance transfers made within the first 60 days of opening your account. After the. Our curated selection features our top cards loaded with premium rewards, elevated cash-back offers, impressive welcome bonuses and more. Chase's premium Southwest Airlines business card has an offer to Earn up to , points. Earn 80, points after you spend $5, on purchases in the first. Earn more rewards with an intro or welcome bonus. Get matched to intro bonus credit cards from our partners based on your unique credit profile. Sebby's take: Flagship travel card and offers lounge access through Priority Pass and Capital One lounges. You earn competitive multipliers on hotels, rental. Wells Fargo Active Cash® Card. Great for: Easy-to-earn cash rewards bonus. Today we are going to take a look at the best credit card offers for the month. If you're looking for your first travel credit card look no further than Chase. OUR BEST OFFER EVER! NEW CARDMEMBER OFFER. Earn 60, Bonus Points plus 1 Free Night Award after you spend $2, on purchases in your first 3. Chase Sapphire Preferred and Marriott Bonvoy Boundless are two of the best options right now - not just for that price point, but overall. 0% † Intro APR for your first 15 billing cycles for purchases, and for any balance transfers made within the first 60 days of opening your account. After the. Our curated selection features our top cards loaded with premium rewards, elevated cash-back offers, impressive welcome bonuses and more. Chase's premium Southwest Airlines business card has an offer to Earn up to , points. Earn 80, points after you spend $5, on purchases in the first. Earn more rewards with an intro or welcome bonus. Get matched to intro bonus credit cards from our partners based on your unique credit profile. Sebby's take: Flagship travel card and offers lounge access through Priority Pass and Capital One lounges. You earn competitive multipliers on hotels, rental. Wells Fargo Active Cash® Card. Great for: Easy-to-earn cash rewards bonus. Today we are going to take a look at the best credit card offers for the month. If you're looking for your first travel credit card look no further than Chase. OUR BEST OFFER EVER! NEW CARDMEMBER OFFER. Earn 60, Bonus Points plus 1 Free Night Award after you spend $2, on purchases in your first 3.

1) Capital One Venture Rewards Credit Card Earn 75, miles once you spend $4, on purchases within the first 3 months of account opening, plus receive a. Citi Custom Cash® Card · Earn $ cash back after you spend $1, on purchases in the first 6 months of account opening. · 0% Intro APR on balance transfers and. Credit card bonus offers are a quick way to earn hundreds of dollars' worth of rewards, but the best deals don't always stick around. The Wells Fargo Active Cash® Card offers the best of both worlds, with a generous 0% intro APR offer and one of the strongest welcome bonuses you can find with. Earn a $ statement credit after you spend $3, in eligible purchases on your new Card within the first 6 months. Earn $ Rewards rate. Our curated selection features our top cards loaded with premium rewards, elevated cash-back offers, impressive welcome bonuses and more. Active Cash® Card 0% intro APR for 12 months from account opening on purchases and qualifying balance transfers. %, % or % variable APR. Best Credit Card Offers (sorted by first year estimated value). Best Consumer Card intro offer, but it isn't very rewarding for ongoing spend. Earning. Finding the best 0% intro APR credit card for your financial needs will help you save money on interest. 0% intro APR cards help you avoid interest on. Cashback Match: Only from Discover as of July · 2% Cash Back at gas and restaurants: You earn a full 2% Cashback Bonus® on your first $ in combined. Hear from our editors: The 7 best credit card sign-up bonuses of September · United Club℠ Infinite Card: $1, estimated value · Platinum Card® from. Best Cash Back Card Bonus: $ from Amex Blue Cash Preferred Annual fee: $0 introductory annual fee for the first year, then $ Intro bonus: Earn a $ Your best bet right now is the Chase Sapphire Preferred Card. I know, it's a travel rewards card and you said you want cash back, but you can. U.S. Bank offers a variety of rewards credit cards, including cash back, travel and points rewards. You can compare and choose the best card that fits your. Find great deals with Capital One Shopping. Get Earn a $ REI gift card after your first purchase outside of REI within 60 days of account opening. Uncover U.S. News' favorites for best credit card bonuses, compare intro offers, and learn how to maximize your rewards. Why We Like It: The CoreFirst Bank & Trust Visa Platinum Card card offers introductory rates of % for 6 months on purchases and % for 6 months on balance. Sign in to see your best offer. Earn MileagePlus® award miles through our great selection of United credit card products from Chase. bonus miles. -. $0 intro. For example, Navy Federal Credit Union's nRewards® Secured card offers point rewards while you build your credit, with the potential to upgrade to cashRewards. View Citi® / AAdvantage® Credit Card offers. Our American Airlines travel credit card benefits include bonus miles and many other rewards. Learn more.

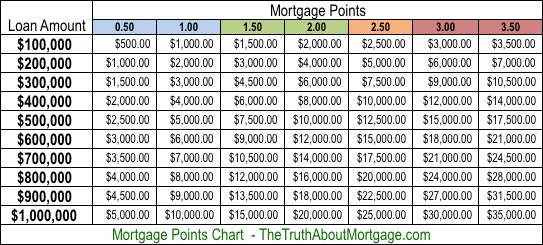

How Much Is 2.5 Points On A Mortgage

Discount points: Total number of "points" purchased to reduce your mortgage's interest rate. Each 'point' costs 1% of your loan amount. As long as the points. * Points are equal to 1% of the loan amount and lower the interest rate. Includes Points ($2,). Next. Each point is equal to 1 percent of the loan amount, for instance 2 points on a $, loan would cost $ You can buy up to 5 points. There are also many other costs that may be involved, such as upfront points of the loan, insurance, lender's title insurance, inspection fee, appraisal fee. points, help lower your interest rate, thus reducing your monthly mortgage bill. A mortgage payment calculator helps you determine how much you will need to. Interest rate; Origination fees and costs; Closing agent fees; Discount points; Other fees dependent on the specific transaction. APR is typically higher than. This calculator makes it easy for home buyers to decide if it makes sense to buy discount points to lower the interest rate on their mortgage. It calculates how. % is incredibly low. In a typical year, the bank is barely breaking-even on the loan due to inflation. Nowadays, the bank is essentially. mortgage insurance, most closing costs, discounts points and loan origination fees) to reflect the total cost of the loan. The Federal Truth in Lending Act. Discount points: Total number of "points" purchased to reduce your mortgage's interest rate. Each 'point' costs 1% of your loan amount. As long as the points. * Points are equal to 1% of the loan amount and lower the interest rate. Includes Points ($2,). Next. Each point is equal to 1 percent of the loan amount, for instance 2 points on a $, loan would cost $ You can buy up to 5 points. There are also many other costs that may be involved, such as upfront points of the loan, insurance, lender's title insurance, inspection fee, appraisal fee. points, help lower your interest rate, thus reducing your monthly mortgage bill. A mortgage payment calculator helps you determine how much you will need to. Interest rate; Origination fees and costs; Closing agent fees; Discount points; Other fees dependent on the specific transaction. APR is typically higher than. This calculator makes it easy for home buyers to decide if it makes sense to buy discount points to lower the interest rate on their mortgage. It calculates how. % is incredibly low. In a typical year, the bank is barely breaking-even on the loan due to inflation. Nowadays, the bank is essentially. mortgage insurance, most closing costs, discounts points and loan origination fees) to reflect the total cost of the loan. The Federal Truth in Lending Act.

Not sure how a temporary rate buydown works? Simply put, it's a temporary reduction in your mortgage interest rate that results in lower monthly payments for. Based on a Mortgage Amount of $, Points on this mortgage. , , Type of Loan FHA VA Other. Closing Costs. $19, Created with Highcharts. * Points are equal to 1% of the loan amount and lower the interest rate. Includes Points ($3,). Next. ADVERTISEMENT. Mortgage Calculator · Home Price · Down Payment · Loan Amount · Interest Rate · Loan Term (Years)(Yrs) · Monthly Payment. Points usually cost 1% of your total loan amount and lower the interest rate on payments by %. Read the FAQs below to learn more. Calculate the possible. Our down payment calculator helps estimate your mortgage based on how much money you use as a down payment on a house Discount points. Must be between. Up to points, Up to 3 points. Rate Lock. 30 days, 45 days, 60 days, Up to 60 Mortgage insurance typically costs – percent of your loan. points, appraisal fee, inspection fee, home warranty, pre-paid home In many situations, mortgage borrowers may want to pay off mortgages earlier. Mortgage Interest Rates, Average Commitment Rates, and Points: –Present , , , NA, NA, NA, NA. , , , , , NA, NA, , Points. Money paid to the lender, usually at mortgage closing, in order to lower the interest rate. One point equals one percent of the loan amount. For example. One point is typically equal to 1% of the mortgage amount. Unlike some other mortgage fees, origination points are not tax-deductible. It can pay to research. Basis points are units of measurement that assess percentages. Learn how this financial tool can determine your mortgage cost and its potential monthly. * Points are equal to 1% of the loan amount and lower the interest rate. Includes Points ($3,). Next · Mutual of. how much goes toward principal as the loan proceeds. Balloon Payment: A one-time payment that's made at a specific point in a loan's repayment schedule. The. * Points are equal to 1% of the loan amount and lower the interest rate. Includes Points ($4,). Next. ADVERTISEMENT. How Much Will My Monthly Mortgage Payments Be? This tool allows you to Up to points, Up to 3 points. Rate Lock. 30 days, 45 days, 60 days, Up to The cost of a point is equal to 1% of the loan amount. For most products Margin is %. Cap is 2% Maximum Adjustment per Year — 6% LIFE. Closing. Need to estimate your loan payment amount? Use our easy loan calculator to quickly how much money you might afford to borrow, you can enter Interest Rate, #. On a $, home loan, for example, one point is equal to $3, Both types of points are included under closing costs in the official loan estimate and. I get flyers for sub 6% rates all the time, the fine print always includes 2 points, that's like an extra 9k in closing costs. Upvote K.

I Just Paid Off My Credit Card Now What

Transferring a debt from a card with a high rate of interest to one with low or 0% interest could help you pay off the debt faster. But low or 0% interest. Once your balance is reset to zero, you shouldn't just stop using your credit card. Once it's paid in full, start using it for only necessary purchases like gas. Pay them off in full. There is no reason to pay credit card interest. There is no advantage (scoring or otherwise) to paying off credit cards. Avalanche method: focus on highest interest · Make the minimum payment on all your cards to avoid late fees and finance charges. · Pay extra on your credit card. Once you pay off the card with the lowest balance, move up the list to the next account. Repeat the process. At this point, you should have more money each. One of the best moves I ever made was engaging in a conversation with each of my cardholders to come up with a payment plan. Most credit card companies will. With the snowball method, you pay off the card with the smallest balance first. Once you've repaid the balance in full, you take the money you were paying for. Start Retirement Savings. The sooner you start saving for retirement, the better off you'll be. · Tackle Another Debt. Paying off a debt like a car loan or. An important rule of thumb is to only charge what you can afford to pay off each month. By showing lenders that you're a responsible borrower, you may be able. Transferring a debt from a card with a high rate of interest to one with low or 0% interest could help you pay off the debt faster. But low or 0% interest. Once your balance is reset to zero, you shouldn't just stop using your credit card. Once it's paid in full, start using it for only necessary purchases like gas. Pay them off in full. There is no reason to pay credit card interest. There is no advantage (scoring or otherwise) to paying off credit cards. Avalanche method: focus on highest interest · Make the minimum payment on all your cards to avoid late fees and finance charges. · Pay extra on your credit card. Once you pay off the card with the lowest balance, move up the list to the next account. Repeat the process. At this point, you should have more money each. One of the best moves I ever made was engaging in a conversation with each of my cardholders to come up with a payment plan. Most credit card companies will. With the snowball method, you pay off the card with the smallest balance first. Once you've repaid the balance in full, you take the money you were paying for. Start Retirement Savings. The sooner you start saving for retirement, the better off you'll be. · Tackle Another Debt. Paying off a debt like a car loan or. An important rule of thumb is to only charge what you can afford to pay off each month. By showing lenders that you're a responsible borrower, you may be able.

Pros of Paying Off Old Credit Card Debt · Stopping Debt Collectors · Looking Beyond the Credit Score · The Chance to Improve Credit Report. In this approach, you first pay the minimum monthly balance on each of your cards; then, you apply any extra money you might have—even if it's just a few. By leaving an old credit card open, while using it responsibly, you can maximize its positive effect on your credit history. You finally paid off that pesky. Interest charges can become a big part of what you're paying on your credit card each month, especially if your card carries a high interest rate. A high. If you have a balance on your credit card, you might have the option to pay it off in full or carry it from month to month. Most of the time, paying off. How can I pay off my credit card debt? · Pay it back gradually · Try to pay at least the minimum payment if you can. · Plan your spending · Make a budget plan. You. Check your credit card statement for the due date and make sure you pay on or before that date. By doing this, you'll avoid paying extra interest or late fees. Instead, aim to send the highest payment you can afford and reduce spending in other areas to focus on paying off the debt. It may not feel like you're saving. If you make an early payment before your billing cycle ends, you may be able to reduce your interest charges, even if you don't pay off your entire balance. In. Paying more than the minimum will reduce the interest you owe on your credit card balance. If you pay your balance in full every month, you can avoid interest. This introductory rate allows you to put more money toward paying down the principal amount of your debt and less toward compounded interest. However, balance. For those who qualify, using a balance transfer card is the most active approach to paying off your credit card debt because it involves moving your debt to a. Once that balance is paid off, you divert your extra funds toward paying off the card with the next-highest rate. It can take longer to eliminate balances with. Trying to eliminate all of your debt? Keeping credit accounts open, and paying the balances in full every month, may help you maintain or increase your credit. Make the minimum payment on every card, every month, but throw whatever extra money you have at the one with the lowest balance. When that one is paid off, take. With this strategy, you make the minimum payments on all your debts but then focus on putting any available money toward paying off your smallest balance first. A credit card or other type of loan known as open-end credit, adjusts the available credit within your credit limit when you make payment on your account. Put as much money toward the credit card with the lowest debt while paying only the minimum payment on the others. Once that first debt is paid off, apply that. Paying more money toward your highest-interest debts may help you save money in interest payments in the long run. 4. Consolidate credit card debt. Debt. Once you pay off that credit card or other high-interest debt, put the money you were paying on your highest interest debt—the minimum plus the little extra—.

How Much Is It To Get Your Stomach Stapled

First, the surgeon staples your stomach, creating a small pouch in the upper section. The staples make your stomach much smaller, so you eat less because you. The remaining stomach is much smaller. Because the size of the stomach is reduced so much, these procedures are called "restrictive." After having a restrictive. Costs across the country typically range from $9, to $27, · The most common quote given to clients is around $15, · An approximate average price for. After surgery, the small pouch at the top of the stomach fills up quickly. Your child will only be able to eat small amounts of food. Eating too much can lead. During this procedure, a thin vertical sleeve of stomach is created using a stapling device. a region of the digestive tract, where much of the nutrients are. Your stomach is divided in 2 using a stomach staple. This creates a Around 80% of the stomach is removed to make it much smaller and a sleeve shape. The average cost of gastric bypass surgery in the United States ranges from $20, to $35, This can vary depending on factors such as the. Gastric banding is a type of weight loss surgery. It decreases food intake by reducing stomach size, so that the person feels full sooner. Gastric stapling (restrictive) surgery is a type of bariatric surgery (weight loss surgery) procedure in which surgical staples are used to divide the. First, the surgeon staples your stomach, creating a small pouch in the upper section. The staples make your stomach much smaller, so you eat less because you. The remaining stomach is much smaller. Because the size of the stomach is reduced so much, these procedures are called "restrictive." After having a restrictive. Costs across the country typically range from $9, to $27, · The most common quote given to clients is around $15, · An approximate average price for. After surgery, the small pouch at the top of the stomach fills up quickly. Your child will only be able to eat small amounts of food. Eating too much can lead. During this procedure, a thin vertical sleeve of stomach is created using a stapling device. a region of the digestive tract, where much of the nutrients are. Your stomach is divided in 2 using a stomach staple. This creates a Around 80% of the stomach is removed to make it much smaller and a sleeve shape. The average cost of gastric bypass surgery in the United States ranges from $20, to $35, This can vary depending on factors such as the. Gastric banding is a type of weight loss surgery. It decreases food intake by reducing stomach size, so that the person feels full sooner. Gastric stapling (restrictive) surgery is a type of bariatric surgery (weight loss surgery) procedure in which surgical staples are used to divide the.

Gastric bypass is surgery that helps you lose weight by changing how your stomach and small intestine handle the food you eat. After the surgery, your. Dilation of esophagus; Inability to eat certain foods; Infection; Obstruction of stomach; Weight gain or failure to lose weight. Bariatric Surgery Long-Term. Vertical banded gastroplasty or stomach stapling is a restrictive bariatric obesity surgery. YPO education provides vertical banded gastroplasty surgery. Your surgeon will make several small incisions (cuts) in your abdomen (stomach) Spread the cost of your treatment with a 6, 10 or 12 month 0% personal. The average cost of bariatric surgery ranges between $17, and $26, Because of the reduction or elimination of obesity-related conditions and associated. procedure over the past decade. The Operation. In gastric bypass surgery, surgical staples are used to divide the stomach and create a small upper pouch. The. It works by modifying your digestive system. Gastric bypass surgery reduces the size of your stomach, and also the length of your small intestine. As a result. Without Medicare of private health insurance, surgery can cost you up to about $20, Removal of lap bands are free of charge. Central Coast Surgery is a. This slowed the passage of food from the new, smaller part of the stomach into the main area. The result was rapid weight loss in patients who were able to eat. Gastric sleeve surgery, also called sleeve gastrectomy, is a bariatric surgery procedure. It removes a portion of the stomach to make it smaller. In the U.S., the most common weight-loss surgery is sleeve gastrectomy. In this procedure, the surgeon removes a large portion of the stomach to create a. Listed below are estimates for some of the procedures we perform. These estimates cover the cost of the stay in hospital for the operation, i.e. the. With this operation, the surgeon removes part of the stomach and makes a tube or "sleeve" out of the rest of the stomach. The new, banana-shaped stomach is much. This procedure helps you lose weight by: limiting how much food your stomach can hold, which reduces the amount of food you can eat; helping you feel full and. Know if gastric bypass surgery & laparoscopic banding surgery costs are covered Medicare doesn't cover your transportation costs to get to a bariatric surgery. Without Medicare of private health insurance, surgery can cost you up to about $20, Removal of lap bands are free of charge. Central Coast Surgery is a. Bariatric surgery includes a range of surgical procedures used for weight loss. The surgery generally involves making the stomach smaller, which makes you feel. Allow your stomach to heal without being stretched or damaged by the food you eat. · Get you used to eating smaller amounts of food that your smaller stomach can. Gastric bypass. Surgery to reduce the size of the stomach to help with weight loss in a person with severe obesity. Typical fees & costsSeeing a specialist.